Introduction to Business Credit Builder

As a business owner, establishing and growing your business credit is crucial for securing funding, favorable terms, and expanding your operations. One powerful tool that can help you achieve these goals is a Business Credit Builder program. These programs are specifically designed to assist businesses in building strong credit profiles that can unlock various financial opportunities.

Benefits of Utilizing a Business Credit Builder Program

By leveraging a Business Credit Builder program, businesses can enjoy a range of benefits, including:

- Access to business credit builder accounts for establishing a positive credit history.

- Opportunity to obtain a business credit builder card for convenient transactions and expense management.

- Guidance on utilizing BUSINESS CREDIT BUILDER loans to finance growth initiatives.

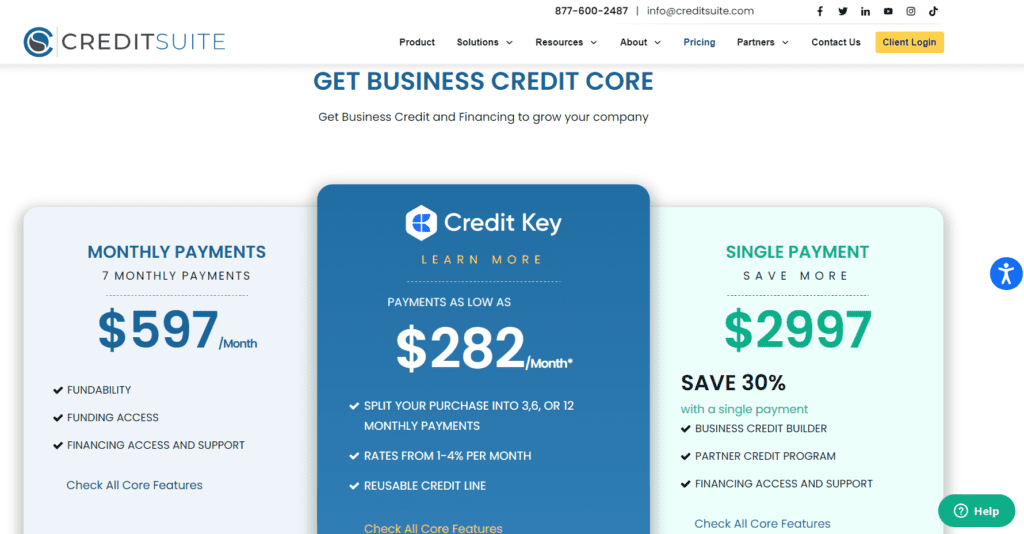

- Insight into reputable business credit builder companies offering tailored solutions.

- Enhancing creditworthiness through business credit builder tradelines.

- Professional assistance from business credit building services to navigate the process effectively.

- Valuable insights from business credit builders reviews to make informed decisions.

Detailed Explanation of Business Credit Builder Programs

A Business Credit Builder program works by helping businesses establish and strengthen their credit profiles through a strategic approach. These programs typically involve opening BUSINESS CREDIT BUILDER accounts, which are specifically designed to report positive payment history to credit bureaus. In addition, businesses can apply for a business credit builder card to manage expenses and improve financial management.

Furthermore, business credit builder loans are available to assist businesses in securing funding for various needs, such as expansion, equipment purchases, or working capital. By working with reputable business credit builder companies, businesses can access expert guidance and tailored solutions to address their unique credit-building requirements.

Frequently Asked Questions about Business Credit Builder

1. What is the primary goal of a business credit builder program?

The main objective of a BUSINESS CREDIT BUILDER program is to help businesses establish and enhance their credit profiles to access better financing options and favorable terms.

2. How can a business benefit from utilizing business credit builder tradelines?

Business credit builder tradelines can help a business demonstrate a positive credit history and strengthen its creditworthiness, making it more attractive to lenders and creditors.

3. Are business credit building services worth the investment?

Yes, business credit building services provide expert guidance and support in navigating the credit-building process, saving businesses time and potential costly mistakes.

4. What should businesses consider when choosing a BUSINESS CREDIT BUILDER card?

Businesses should look for a BUSINESS CREDIT BUILDER card with favorable terms, rewards, and reporting features to effectively manage expenses and build credit.

5. How can businesses leverage business credit builder loans effectively?

Businesses can use business credit builder loans to fund growth initiatives, manage cash flow, and establish a positive borrowing history to qualify for larger loans in the future.

Conclusion

In conclusion, a Business Credit Builder program is a valuable resource for businesses looking to establish, enhance, and leverage their credit profiles effectively. By utilizing business credit builder programs, businesses can access a range of benefits, including access to credit builder accounts, cards, loans, and expert guidance from reputable companies. With the insights and tools provided by business credit builders, businesses can navigate the credit-building process with confidence and achieve their financial goals.